There is growing interest in deep-sea mining from both sides of the aisle – ardent defenders who believe it can meet the world’s pressing need for critical minerals and others who agree that it might do irrevocable damage to marine ecosystems and ocean health.

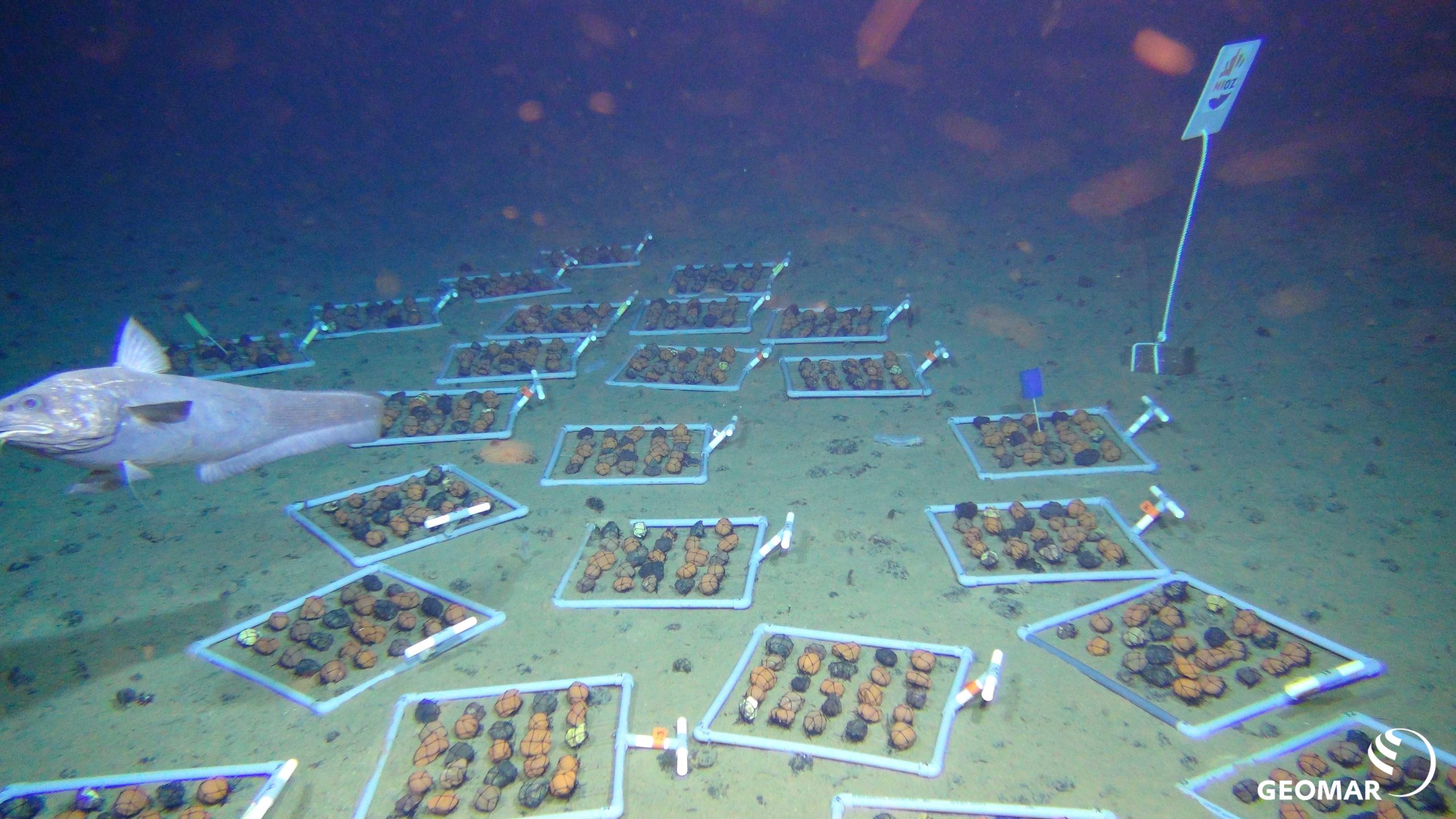

From the activist lens, SIGWATCH data shows that campaigning on deep-sea mining has seen a 54% increase in the last year.

Groups are using the precautionary principle in their discourse to apply pressure on businesses and governments. Most recently, the Norwegian government came under fire for approving deep-sea mining without adequate information on the scale and severity of impacts.

The message from activists is clear:

Just because risks are largely unknown and hard to quantify, this does not mean that they are less than the risks associated with extracting these minerals on land. Focus on managing those first.

And it seems they’re not alone. Big names in business are with them on this one.

The precautionary principle

It’s a tale as old as time:

Society has specific needs to meet.

Business sees an ‘innovative solution’ – an opportunity – and is keen to pursue it before those needs become problematic.

Activists see an untested solution – a risk – and ramp up the pressure on public, policymakers, and business to halt the charge, before those risks become reality and cause even bigger problems.

The tension we see here reflects the differing positions of civil society and business on the precautionary principle, and we’ve seen it time and again, from fossil fuels and CO2, to GMOs and food-systems, to pesticides and community health.

The newest issue: deep-sea mining

And the debate is heating up. In January 2024, the Norwegian parliament approved a proposal to open its continental shelf to commercial deep-sea mining. The language of the proposal is cautious and even names the precautionary principle, but activists are not convinced, and Norway has seen 30% of global targeting on the issue this year – including pressure from international coalitions.

Activists say stop. They argue that the impacts of deep-sea mining cannot be quantified and will threaten carbon storage, coastal communities, and the fishing industry. There are also fears that it will set a dangerous precedent, opening the doors for more deep-sea mining endeavours in different jurisdictions.

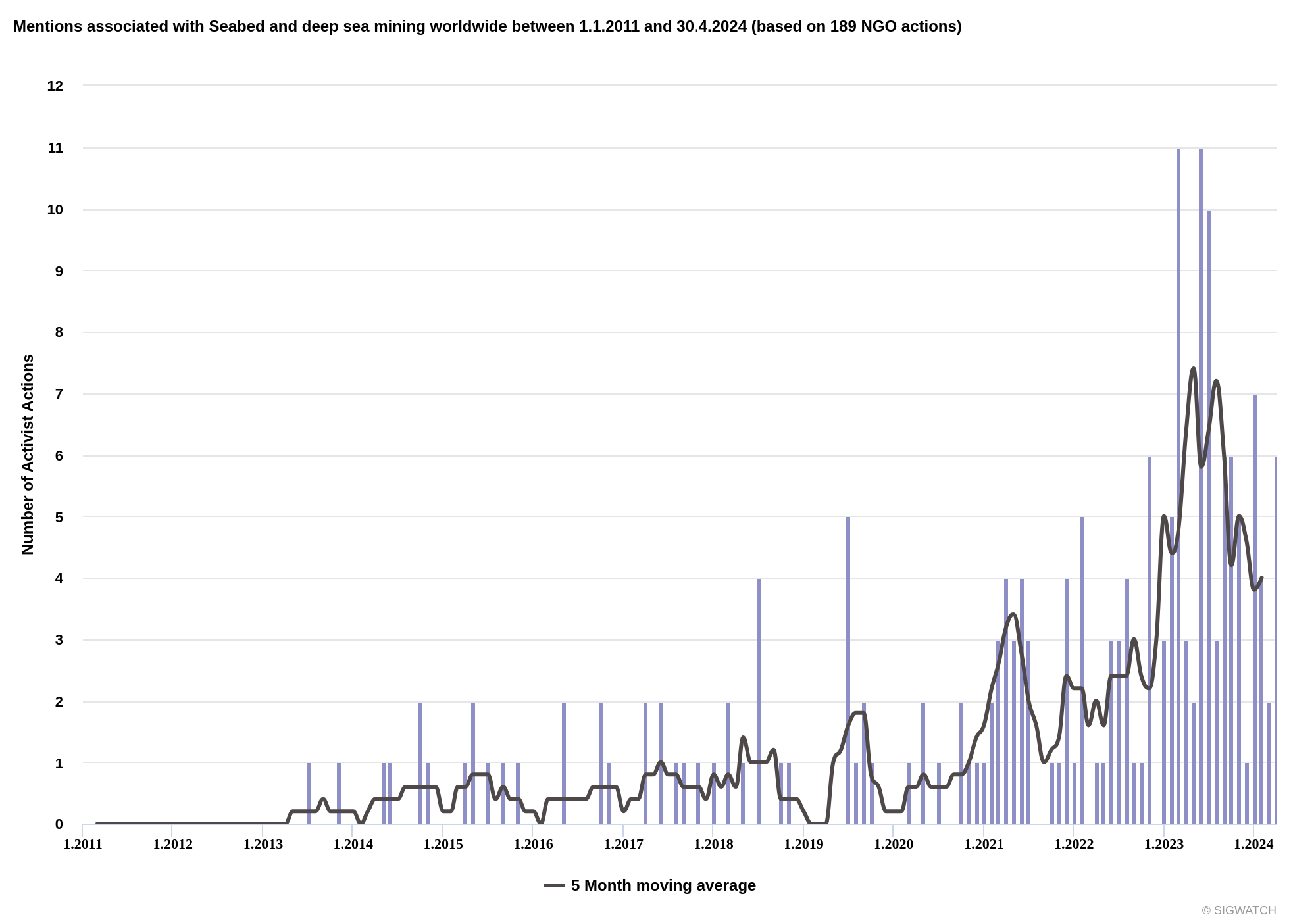

But businesses need to drive the energy transition. This requires huge amounts of copper, cobalt, nickel, zinc and other minerals. The environmental and social risks associated with extracting these minerals on land are huge but they are theoretically available in abundance on the seabed.

Precautionary business

However, activists have received a surge of confidence from big business.

Several companies have anticipated the reputational risks and committed to a moratorium on using deep-sea-mined minerals. These include automakers such as BMW, Volvo, VW, and Renault and tech companies like Google, Microsoft, Samsung and Salesforce. The European Investment Bank has also refused to invest in deep-sea mining projects.

Moves like these can provide campaigners with a powerful tool to increase the pressure on other stakeholders, and groups are already using these commitments to pressure others to follow suit.

So, what can business do?

Alongside better management of current supply-chain risks, activists advocate resource efficiency. Campaigners have claimed that a circular economy focus could cut cumulative mineral demand by 58% between 2022 and 2050.

Regardless of the path chosen, one thing is clear – risk management will be key.

If mining companies focus on the seabed, campaigners will ramp up the pressure and push the issue up the agenda. Their campaigns already have significant weight, so be prepared.

And if the increasing demand for transition minerals is to be met by mining on land, we know the environmental, social, and reputational risks are huge here too. Understanding these risks and how they might impact stakeholders in your value chain is an imperative.

What our clients say

What our

clients say

“In our experience, SIGWATCH is one of the few sources of ESG data we can absolutely trust to be reliable.”

“Our company is based in Japan. Most employees are Japanese and we don’t really know what is happening around the world. SIGWATCH gives us visibility of the global ESG issues and trends we need to have on our radar.”

“With SIGWATCH, we’re able to absorb NGO data in an awesome way that

simply wouldn’t be possible otherwise. We can hear the NGOs’ voice, to better

strategize and get ahead of trending issues.”

“With social listening, we’re limited to knowing what people are saying only about OECD. With SIGWATCH, we see not only what is being said about us, but also what is being said about everyone else.”

“A lot is said and written about sustainability and ESG every day but no one,

apart from SIGWATCH, provides the big picture, SIGWATCH offers a comprehensive overview of what’s happening in the corporate sustainability

world rather than just a narrow snapshot.”

“SIGWATCH is a good source to show that NGOs are watching us and watching our clients, and we definitely need to be aware of the issues they are bringing up.”